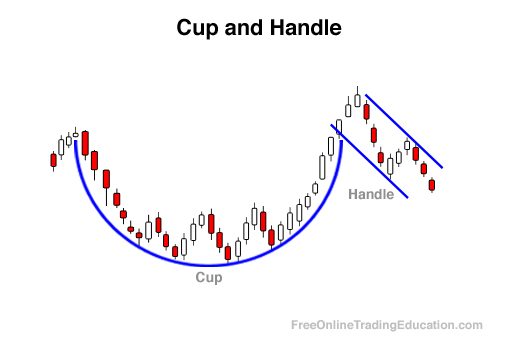

Patrón Operable - Tasa con Asa

|

Definición:

La "Taza con Asa" se forma de tres etapas: 1) un retroceso después de un pico máximo; 2) seguido por un repunte o rally de precio que llega hasta el pico anterior sin rebasarlo o rebasándolo sólo un poco; y 3) retrocede nuevamente pero de manera ordenada (como una bandera bull). La taza con Asa se forma antes de que el precio explote hacia arriba rebasando los dos picos anteriores. Antecedentes: El poder de una taza con Asa está en que, después de haber tocado la resistencia superior dos veces, se da una pequeña corrección que forma el asa. Después el precio rompe a través de la resistencia superior, lo cual confirma que la demanda por esa acción se ha incrementado. El patrón de Taza con Asa puede ser más fuerte cuando el siguiente punto de resistencia superior después del rompimiento se encuentra lejos de éste. Uso práctico: Los analistas técnicos utilizan a menudo ´la "taza con Asa" como oportunidad de compra debido a la habilidad de este patrón de "confirmar" la falta de presión de venta en ese intervalo de tiempo. |

Descarga 6 videos tutoriales Básicos de Trading (enviados a tu email) -- ¡GRATIS! Haz click aquí.