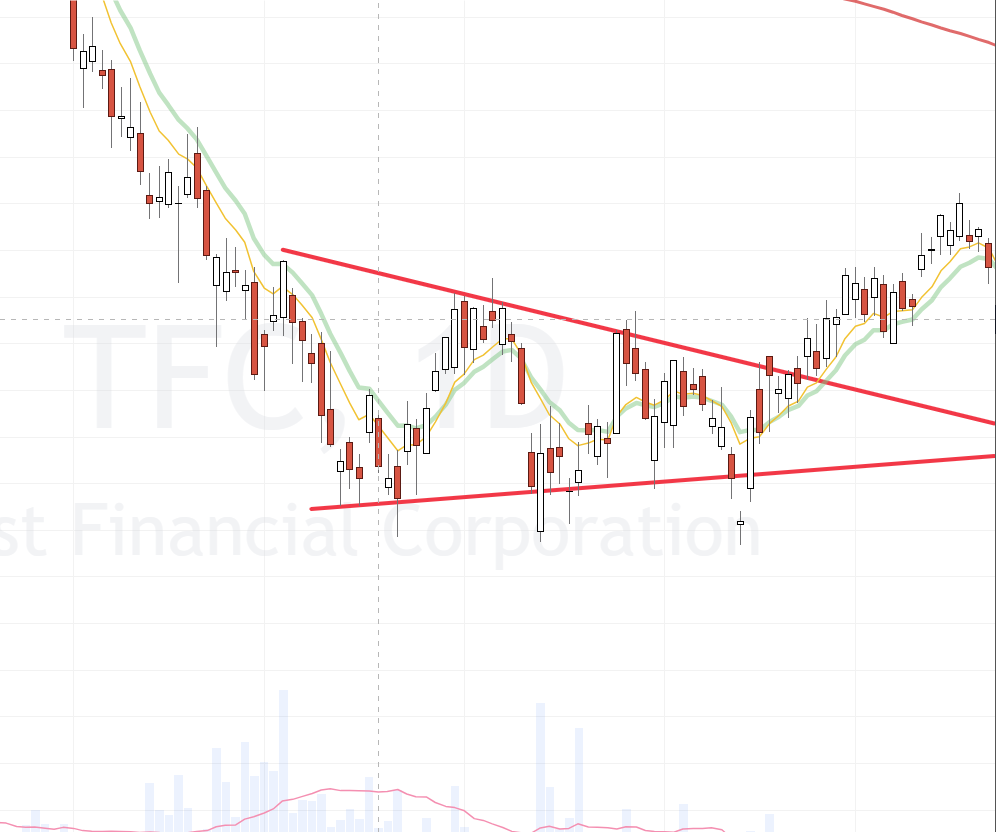

BULLISH DEATH HOOK

a Bullish Death Hook* takes place when the price action first breaks down below a symmetrical triangle, indicating a potential continuation of the bearish trend, but then reverses sharply back within the triangle. This false breakdown usually leads to a sharp rally in price. This false breakdown can lead to a substantial upward price movement. Traders might see this as a bullish signal and may consider entering long positions, expecting prices to rise significantly above the triangle.

Death Hooks*, whether bearish or bullish, are important chart patterns that traders should be aware of when analyzing symmetrical triangles in technical analysis. These patterns signify false breakouts or breakdowns, often leading to substantial price moves in the opposite direction. Understanding and identifying Death Hooks* can help traders make informed decisions, employing appropriate risk management strategies to protect their capital. Keep in mind that while these patterns can be profitable, no trading strategy is foolproof, and it is essential to use them in conjunction with other technical analysis tools and sound risk management principles.

*Des Woodruff, the founder and owner of Free Trading Videos.com, Inc., DBA Grok Trade, innovatively devised the "Death Hook" trading pattern. He is credited with not only identifying this unique and pivotal pattern within the trading landscape but also with coining the distinctive term "Death Hook" to describe such trading setups.